12 Small Purchases That Quietly Drain Your Bank Account

Small, everyday expenses can chip away at your savings without you noticing. Over time, these purchases can leave you with less money for your priorities.

Understanding which tiny habits quietly drain your savings helps you take better control of your finances. Being aware of these spending patterns is the first step toward making smarter choices without feeling deprived.

Daily coffee runs

Enjoying a coffee on your way to work can become a costly habit. Spending around $5 daily on coffee could cost you over $1,800 a year.

Making coffee at home just a few times a week can save you hundreds. It’s a simple change that helps you keep more money in your pocket.

Being aware of how often you buy coffee out helps you spot easy ways to cut back.

Streaming service fees

Streaming services are convenient and offer a lot of entertainment options. However, if you subscribe to several platforms, the costs can add up quickly.

You might be paying for multiple services with overlapping content. Checking your subscriptions regularly helps you avoid paying for services you rarely use.

Some platforms have tiered pricing with extra charges for HD or multiple devices. Make sure you choose the plan that fits how you actually watch to save money.

Impulsive snack buys

Quick snack stops can add up before you know it. Grabbing a soda or candy bar on a whim seems small, but these expenses happen frequently.

Convenience stores often charge more than grocery stores, so your quick treat costs more than expected.

If you want to save, try pre-buying snacks in bulk. This helps prevent those impulse stops and keeps your spending in check.

Delivery and shipping charges

Delivery and shipping fees might seem small, but they add up faster than you expect. Whether you’re ordering food, groceries, or online shopping, these extra costs quietly inflate your bill.

Sometimes, you pay for expedited shipping without really needing it. Choosing standard delivery or picking up your order can save you money.

Look out for service fees on food delivery apps too. Preparing a meal at home or using pickup options can help you avoid these repeated charges.

Unused gym memberships

If you have a gym membership you rarely use, it could be quietly costing you money each month. Many people sign up with good intentions but stop going after a few weeks.

Gyms often make canceling memberships tricky, which can lead to paying for months you don’t benefit from.

Consider replacing your gym visits with free options like outdoor walks or workout apps. Cancelling an unused membership can free up money for things you actually enjoy or need.

ATM withdrawal fees

When you use an ATM outside your bank’s network, you might face withdrawal fees. These charges can be small but add up over time without you noticing.

Some banks also apply maintenance fees that sneak in alongside ATM costs. To avoid these, try using your bank’s ATMs whenever possible.

Withdrawing larger amounts less often can also reduce the number of fees you pay. You could also consider a debit card that offers cash-back options to avoid frequent ATM visits.

Buying bottled water

Buying bottled water might seem like a small, convenient choice. But those $1-$2 bottles can add up quickly if you buy them every day.

Instead, investing in a reusable water bottle can save you money over time. You can also consider using a water filter at home to reduce costs even more.

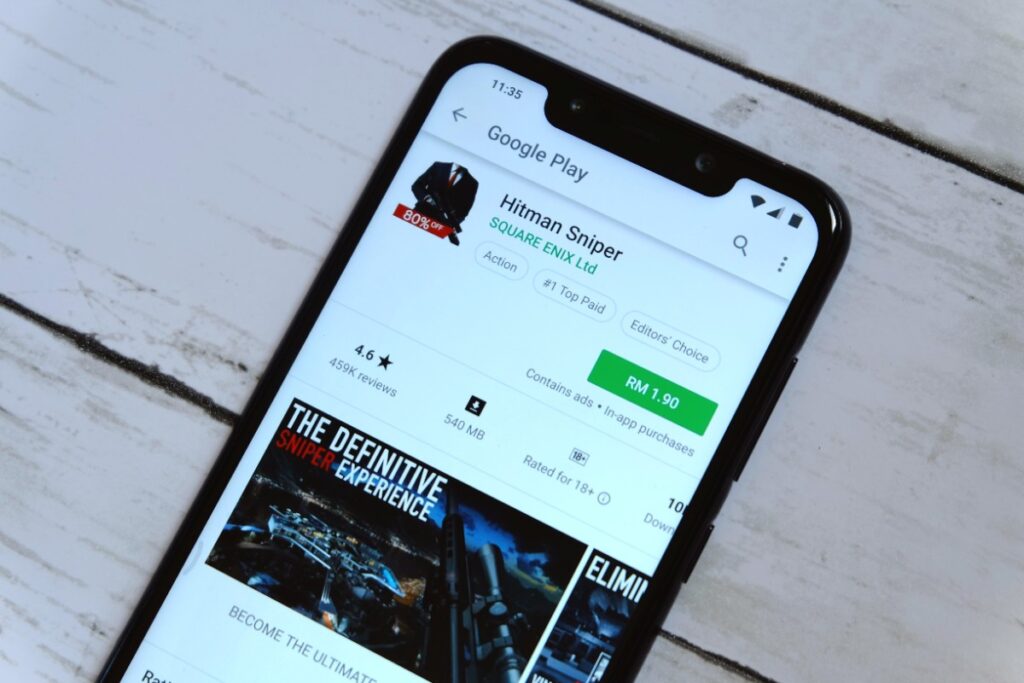

Impulse app purchases

You might not notice how often small app purchases add up. Buying extra features, game upgrades, or monthly subscriptions can quietly drain your finances over time.

It’s easy to tap “buy” when you’re caught up in the moment, especially with in-app offers designed to grab your attention.

Try setting limits or reviewing your app spending regularly. Taking a moment before purchasing can help you decide if you really need that extra feature or if it’s just an impulse buy.

Premium smartphone upgrades

Upgrading your smartphone every year can quickly add up, even if each new device feels exciting. New models often come with features you might not use regularly, yet the cost still impacts your budget.

If your current phone works well, waiting a few years between upgrades can save you a significant amount. This way, you avoid unnecessary expenses and get more value from your devices.

Consider whether paying extra for the latest model truly benefits you. Sometimes, sticking with what you have is the smarter, friendlier choice for your wallet.

Memberships you forget

You might be paying for memberships you don’t even use. Gym, streaming, or club memberships often renew automatically, quietly taking money from your account each month.

It’s easy to lose track, especially if you signed up during a moment of motivation or curiosity. Checking your bank statements regularly can help you spot these charges.

Cancel any membership that no longer fits your lifestyle or budget. This simple step can free up funds without much effort on your part.

Impulse holiday decor

Impulse holiday decor purchases can sneak up on your budget. A few ornaments, lights, or themed trinkets can quietly drain your bank account over time.

It’s easy to get caught up in the festive mood and grab extras you don’t really need. Setting a simple spending limit before shopping can help keep your holiday decor spending in check.

Instead of buying new items every year, try reusing what you already have. This way, you still enjoy the festive feeling without continuously spending on impulse decor.

Subscription auto-renewals

Subscription auto-renewals can quietly add up without you realizing it. You might sign up for a service and forget to cancel before the next billing cycle.

These small, recurring charges can slip past your attention. It’s easy to overlook them since each fee feels minor on its own.

You can try using virtual or prepaid cards to avoid unwanted renewals. Regularly reviewing your accounts for active subscriptions helps you stay in control.